Contents:

It will use your strategy in different market conditions to improve your decisions. Expert Advisors An Expert Advisor system collects vast amounts of data and process it to create a complex model based on a set of pre-defined YES/NO rules. It analyzes charts of the assets on which it operates and collects data from indicators according to the defined strategy. When identifying the direction of the trend and the point at which to open a transaction, it calculates the size of the transaction according to the size of the account and the level of risk. It then manages it according to what is happening in the market and according to strategy rules, before ending the position. IG offers a variety of automated trading systems for you to use, including ProRealTime, MetaTrader4 and APIs.

Designing your own trading software requires a basic understanding of programming as well as knowledge about how to code a trading algorithm. Software packages will help make the process easier, but all of them require a basic programming knowledge. Even big commercial operations have had issues with trading robots that carry out surprising trades or are triggered by other robots’ actions to commit large sell-offs.

What is the Best Automated Forex System?

You must make a $250 deposit to start using TeslaCoin, but you can try out the platform in demo mode before risking real money on trades. According to NFT Profit’s website, this automated trading system has a 99.6% success rate. What’s even more impressive is that there are no trading fees for using NFT Profit. All you have to do to get started is sign up and make a $250 deposit to seed your account.

- Investments involve risks and are not suitable for all investors.

- MT4 is a platform that comes with charts and a huge selection of trading tools.

- Agree to some extent that over exposer could be harmful and Yes, there are n number of ppl trying to sell thier MoneyMinting Algo softwares but not all are looking at algos.

- Triangular arbitrage involves the exchange of a currency for a second, then a third and then back to the original currency in a short amount of time.

- If you chose to develop the software yourself then you are free to create it almost any way you want.

Broker’s will offer different CFDs and trading tools, for example, Pepperstone provides free Smart Trader Tools, while others add-on social trading tools. Experienced traders looking to make extra cash can register as a signal provider and share trading strategies, similar to eToro’s Popular Investor program. Members of the MetaTrader community can create “signals”, which other users can follow and automatically copy. Over 3,200 free and paid trading signals are available and are ranked by past trading success. CTrader Automate offers sophisticated backtesting features, meaning you can easily optimise cBots by testing them against historical data.

Our Core Product for Traders

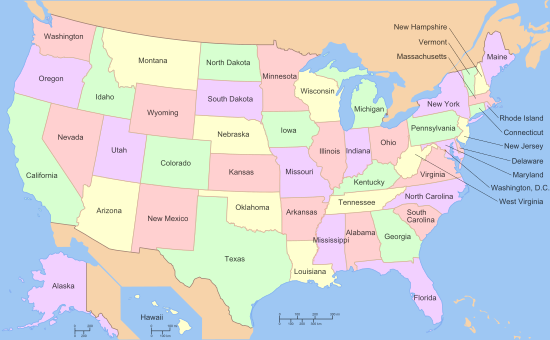

Jenna joined TradersBest.com last year and now heads all of our trading content, working remotely from her home in Massachusetts. Your robot will be programmed to follow the rules you give it. If you see a greater average pattern of losses, then you will need to rethink your trading strategy and make appropriate changes. Conversely, there are a few negative aspects to robots, but not too many.

There are a number of popular automated trading systems that are widely used in current markets. These are classified as different strategies namely momentum strategies, statistical arbitrage, market making, etc. Automated trading system can be based on a predefined set of rules which determine when to enter an order, when to exit a position, and how much money to invest in each trading product. ATSs allow a trader to execute orders much quicker and to manage their portfolio easily by automatically generating protective precautions.

Readers to exercise caution/due diligence, and comply with all applicable laws, including but not limited to taxation laws. What makes the platform unique is that funds in your account are held in TeslaCoin, which has appreciation potential of its own. Using TeslaCoin also enables the trading robot to swap between cryptocurrencies incredibly quickly. This entire process of creating the automated system will need you to have the knowledge of a programming language such as Python, C, etc. With this programming language, you will be able to code the system with all the necessary abovementioned preferences.

Bitsgap is integrated with 30 different exchanges, including top ones like Binance, Kraken, and Bitfinex. On top of that, it offers access to over 10,000 cryptocurrency trading pairs and various technical indicators to help establish your strategies. The intuitive interface makes automated trading possible for beginners and professionals alike. Another great option for an AI crypto trading bot is Bitsgap, which offers crypto trading bots, algorithmic orders, portfolio management, and free demo mode in one place. One of the top selling points of Bitsgap is that it makes it possible to connect all of your exchanges in one place. This has many great benefits, such as allowing you to execute strategies easily and deploy advanced bots simultaneously across platforms.

Algos in the Indian context

That’s because https://1investing.in/ trading is a complex trading strategy that can make your trading life so much simpler, but it is not perfect. But, a lot of traders prefer to develop their personal unique indications and approaches when it comes to the timeline of a trade. They frequently work collaboratively on system development with the coder. Although it usually takes more work than employing the platform’s guide, this method offers far more freedom, and the outcomes could be more satisfying. With automated trading, people who have little experience in the marketplace are able to feel comfortable and talented, and capable of executing the right trade at the right time. Algo trading could be profitable to those organizations who need to spread out the execution of a larger order or perform trades too fast for human traders to react to.

Bank of New York Mellon Corp. stock outperforms competitors on strong trading day – MarketWatch

Bank of New York Mellon Corp. stock outperforms competitors on strong trading day.

Posted: Mon, 10 Apr 2023 20:40:00 GMT [source]

This was demonstrated in August 2012 by the Knight Capital group; who lost over $440 million in just half an hour when their trading software went rogue in response to market conditions. Over-optimisation – a focus on curve-fitting leads to automated trading algorithms often falling short when it comes to live trading. For example, a lot of investors fine tune a plan with almost 100% profitable trades that don’t ever experience a drawdown.

The automated trading system determines whether an order should be submitted based on, for example, the current market price of an option and theoretical buy and sell prices. The theoretical buy and sell prices are derived from, among other things, the current market price of the security underlying the option. A look-up table stores a range of theoretical buy and sell prices for a given range of current market price of the underlying security.

However, some traders may erroneously believe this to be the case. If this is the case, when backtesting a strategy over historical price data, it is possible that the trader will « over-optimise » their strategy. However, the reality is that automated trading systems need to be monitored. Automated trading made appear easy on paper, however, the reality does not always reflect this. Despite the advantages we have listed above, using automated trading software also carries certain disadvantages which you should be aware of.

- Hey Rajesh, I guess you know that if trades are executed on these platforms, brokerage revenue is generated for us.

- Once you’ve applied and been accepted as a member of eToro’s Popular Investor Program, you’ll get paid a commission when other users copy your trading strategies.

- They’ve gained a lot of respect back in 2015 when the platform was awarded an EU Portfolio Management License.

- Not being able to build a multi-time frame logic is a big detriment for me personally, as my strategies are based around that.

npv and irr defineds are initiated based on the occurrence of desirable trends, which are easy and straightforward to implement through algorithms without getting into the complexity of predictive analysis. Using 50- and 200-day moving averages is a popular trend-following strategy. Traders do have the option to run their automated trading systems through a server-based trading platform. These platforms frequently offer commercial strategies for sale so traders can design their own systems or the ability to host existing systems on the server-based platform. For a fee, the automated trading system can scan for, execute and monitor trades, with all orders residing on the server.

You can configure the trading bot to automatically trade 24/7, as well as use algorithmic and social trading. You understand that there is no strategy provider or recommendation service that is free from the risk of loss. If you do not agree with the terms of the disclaimer, please exit the website and do not use any of its investment products.

To facilitate this, a lot of systems use very low-level programming languages to optimise the code to the specific architecture of the processors. The entire packet is directly mapped into the userspace by the NIC and is processed there. Interrupts are signals to the processor emitted by hardware or software indicating that an event needs immediate attention.

YouTube channel for Intro and demo videos on how to use the technical indicators. Receive alerts for deployed algos on the go, when signals are triggered. Streak is a startup that we have partnered as part of Rainmatterin our quest to broaden retail participation in the Indian capital markets. Yes, Automated trader works with every indicator, alert or strategy on tradingview.

Amazon.com Inc. stock outperforms competitors on strong trading day – MarketWatch

Amazon.com Inc. stock outperforms competitors on strong trading day.

Posted: Mon, 10 Apr 2023 20:30:00 GMT [source]

Much of the best automatic trading software aims to let traders set their parameters go to sleep or turn on the TV while it makes trades and earns a profit for them. Anyone, or anything, can press a button and make a trade. However, we should never become dependent on computer software. You can avoid unexpectedly losing time and finances when choosing an auto trading software by requesting detailed documentation revealing the logic the auto trading software is based on. Certain software languages require a specific operating system to function on, while others can operate on any operating system.