Content

- What’s A Bitcoin Exchange?

- Bitcoin Cash Trading Now Available On Gdax

- How Do Centralized Bitcoin Exchanges Work?

- What Are The Disadvantages Of Centralized Crypto Exchanges?

- How Centralized Cryptocurrency Exchange Works: 2 Types Of Platforms

- How Does Bitcoin Exchange Work?

- Differences Between Centralized And Decentralized Exchanges

Understand how the Bitcoin public blockchain tracks ownership over time. Get clarity on key terms like public & private keys, transaction inputs https://xcritical.com/ & outputs, confirmation times, and more.What is Bitcoin governance? Get the basics of how cryptocurrencies are taxed and what it means for you.

A hot wallet is used to receive money on the crypto exchange and give payments to traders. There are many cryptocurrency exchanges, and soon their number will be over a thousand. In this article, we will consider two types of cryptocurrency exchanges, as well as a more convenient trading option — a broker. An exchange will not allow this to happen, as it safeguards the holdings in place of the individual investor.

What’s A Bitcoin Exchange?

Regulators impose this requirement on exchanges ostensibly to prevent money laundering, terror financing, and tax evasion. Regulators also typically require exchanges to report customer information upon request. However, not all of them will be successful, and it’s not uncommon for these exchanges to fold. The success or failure of an exchange is dependent upon a large number of factors. The reason for this setup is that banks offer security and monitoring that an individual cannot accomplish on his or her own.

A fully-banked exchange will allow to you fund your account via bank transfer and send local currency back to your bank account. Fund your newly created account with bitcoin, another cryptocurrency or, if the exchange allows it, local currency. There are several challenges, and each one needs careful consideration before a country launches a CBDC. Citizens could pull too much money out of banks at once by purchasing CBDCs, triggering a run on banks—affecting their ability to lend and sending a shock to interest rates. This is especially a problem for countries with unstable financial systems. CBDCs also carry operational risks, since they are vulnerable to cyber attacks and need to be made resilient against them.

An external drive or a separate computer can be used as a cold wallet. Bitcoin is a digital or virtual currency created in 2009 that uses peer-to-peer technology to facilitate instant payments. Another crucial element of a successful centralized exchange is security. While no exchange is completely immune to malicious activity like hacks, some are safer than others. Full BioNathan Reiff has been writing expert articles and news about financial topics such as investing and trading, cryptocurrency, ETFs, and alternative investments on Investopedia since 2016. Binance, the world’s largest crypto exchange, has been hit with regulatory action worldwide.

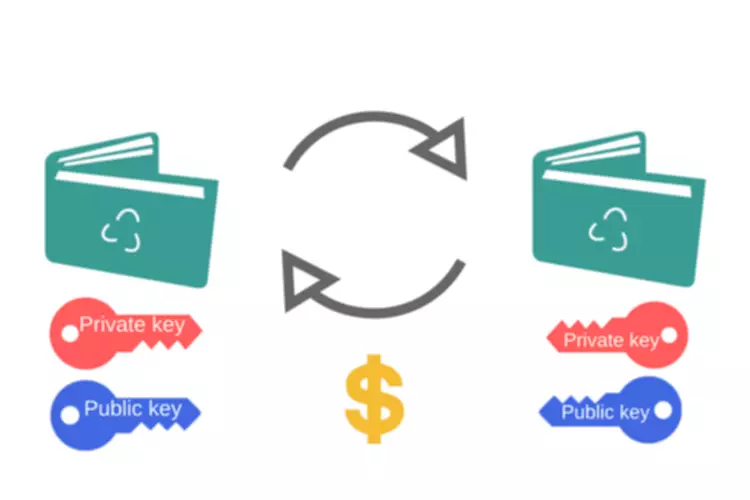

Buyers and sellers alike trust this middle man to handle their assets. This is common in a bank setup, where a customer trusts the bank to hold his or her money. For this reason, most centralized cryptocurrency exchanges require you to complete a registration process in which you must verify your identity before you can use the platform.

Bitcoin Cash Trading Now Available On Gdax

Critically, by definition, a centralized cryptocurrency exchange takes custody of your bitcoin. This has a number of implications relating to security, but also relating to the freedom you have to use your bitcoin as you wish. A bitcoin exchange is any service that matches buyers of bitcoin with sellers. Exchanges are what make Bitcoin a liquid asset for traders at large scale. Some of the largest cryptocurrency exchanges in the world are those that offer these fiat/cryptocurrency pairs, however.

People who place buy and sell orders on exchanges are known as market makers. The more orders there are on the book, the easier it is for people to buy and sell large amounts of bitcoin at closer to the global market rate. In markets, takers are those who reduce liquidity by taking orders that are already on the books. You can also be a taker when you place a limit order if your order happens to match with another person’s order that’s already on the books. The first provides an opportunity to buy a large number of various coins and hold them for as long as needed. The second provides a smaller list of coins, but a wider choice in terms of trading style, namely the ability to short and use leverage.

Note that many exchanges exclude certain nationalities from using the exchange altogether. The next level of verification typically entails uploading nationally-issued identification like a passport or driver’s license. Sign up to receive expert analyses from our community on the most important global issues, rapid insights on events as they unfold, and highlights of the Council’s best work. The financial system may face a significant interoperability problem in the near future. The proliferation of different CBDC models is creating new urgency for international standard setting. 19 of the G20 countries are exploring a CBDC, with 16 already in development or pilot stage.This includes South Korea, Japan, India, and Russia.

How Do Centralized Bitcoin Exchanges Work?

Third, centralized exchanges are often slow and cumbersome to use. This is because they need to follow know-your-customer and anti-money laundering regulations, which can slow down the process of buying and selling cryptocurrencies. When most people speak of bitcoin exchanges, they’re referring to centralized ‘custodial’ platforms like Coinbase, Kraken, and Binance. These platforms facilitate the trade of bitcoin and many other cryptocurrencies. Similar to platforms for trading stocks like Robinhood and Charles Schwab, cryptocurrency exchanges match buyers and sellers. There are already thousands of digital currencies, commonly called cryptocurrencies.

- Understand how the self-custodial model puts you in charge of your cryptoassets and protects you from third-party risk.

- The next level of verification typically entails uploading nationally-issued identification like a passport or driver’s license.

- This can be a great way to increase your profits, but it can also be very risky.

- It’s necessary to note that such distinction is based on the audience an exchange has chosen for its business operation.

- Atomic swaps are smart contracts that enable the exchange of cryptocurrencies from different blockchains in one transaction instead of many.

- This has a number of implications relating to security, but also relating to the freedom you have to use your bitcoin as you wish.

The daily exchange of bitcoin is measured in the tens of billions of dollars! Still, compared to cash, it’s not liquid, particularly when it comes to using it to buy something in the real world. For active trading activity, traders and investors more and more often use the services of brokers. Some are regulated by the Financial Commission, while exchanges may never receive full legal regulation.

What Are The Disadvantages Of Centralized Crypto Exchanges?

Most DEXes rely on Automated market makers to match orders without human intervention. Accordingly, they don’t need custodial storage of user funds as the order matching is automated. In the term « centralized cryptocurrency exchange, » the idea of centralization refers to the use of a middle man or third party to help conduct transactions.

They avail customer support in case you have any problems with your account. This is not something that you will find on a decentralized exchange. In many cases, you’ll be allowed to begin using the exchange by verifying your email only. It’s important to note that this ‘lite verification’ typically comes with considerable restrictions including limited purchase amounts, limited withdrawals, and in some cases, no withdrawals at all. Before you fund a cryptocurrency exchange with bitcoin or any other cryptocurrency, be sure to check that you’ll be allowed to withdraw. Bitcoin is designed to enable peer-to-peer value exchange just like cash, but in the digital realm.

Assets are never held by an escrow service, and transactions are done entirely based on smart contracts and atomic swaps. They offer a better price for your coins because they can match buyers and sellers more efficiently. This means that you are more likely to get the price you want when you trade on a centralized exchange. This is where you borrow to increase your position, creating what’s known as leverage. Exchanges that offer margin trading typically charge additional fees based on the amount borrowed and an interest rate determined by the total supply of funds available to all traders. You’ll also likely be charged an additional fee if your position is liquidated.

When you create a market buy order, you only need to indicate how much bitcoin you’d like to buy (you don’t set the price). The exchange will automatically match you with the seller currently offering the lowest price, and execute your trade. Market orders are, by and large, instantly completed, meaning the moment you submit the order, you’ll receive your bitcoin in your exchange wallet/account. When you create a limit buy order, you’re indicating how much bitcoin you’d like to buy and the price you’re willing to pay for it. They give a wider range of features than a decentralized exchange. For example, most centralized exchanges offer margin trading, which allows you to trade with leverage.

Finally, CBDCs require a complex regulatory framework including privacy, consumer protection, and anti-money laundering standards which need to be made more robust before adopting this technology. It is also worth noting that both types of exchanges can be hacked, and there is an issue of trading bots because of which users often lose money. A blockchain is a digitally distributed, decentralized, public ledger that exists across a network. Birake is a cryptocurrency exchange platform that bills itself as the first « white label » cryptocurrency exchange.

How Centralized Cryptocurrency Exchange Works: 2 Types Of Platforms

Centralized crypto exchanges are websites that serve as cryptocurrency marketplaces. Some are pure exchanges, while others, like Binance, are ecosystems that include a blockchain with their native tokens. how to start a forex brokerage Centralized exchanges facilitate large-scale crypto trading by keeping large amounts of coins and tokens for liquidity. Cumulatively, they account for over 95% of all crypto trading globally.

How Does Bitcoin Exchange Work?

A high-end collector’s car, meanwhile, would be an even less liquid asset, since the pool of potential buyers is smaller. New payments systems create externalities that impact the daily lives of citizens, and can possibly jeopardize the national security objectives of the country. They can, for example, limit the United States’ ability to track cross-border flows and enforce sanctions.

These factors combine to make most peer-to-peer bitcoin exchange platforms considerably less liquid than most centralized cryptocurrency exchanges. Centralized and decentralized exchanges aim to achieve the same goal but through different means. For centralized exchanges, there is an element of human management supervising exchange activities.

Most exchanges charge a fee to withdraw bitcoin, other cryptocurrencies, and local currencies. The withdrawal fees charged by exchanges tend to change frequently, often without notice. 10 countries have fully launched a digital currency, with China’s pilot set to expand in 2023.

Binance in July press conference said it’s been working to become a fully compliant institution. He said Binance needs to have clear records of stakeholders’ ownership, transparency and risk controls. Get the inside scoop on what traders are talking about — delivered daily to your inbox.

Differences Between Centralized And Decentralized Exchanges

This means you can trade bitcoin for anything you want, and you can do so without using intermediaries like banks or payment apps. For example, if someone paints your house, you could potentially negotiate to send the person an agreed amount of bitcoin as payment. This would be effectively no different than handing over cash in exchange for the house-painting service. Since many investors in the space are relatively new to investing in digital currencies, they may be more likely to turn to these types of exchanges. Some of these exchanges include Coinbase, Robinhood, Kraken, and Gemini.

Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. As of the date this article was written, the author owns bitcoin and ripple. Binance’s rebuilding efforts come as the cryptocurrency market this year has swelled to a valuation of more than $2 trillion. Many countries are exploring alternative international payment systems.

Liquidity refers to the ease with which you can trade in and out of an asset – and it depends largely on the number of buyers and sellers there are for an asset. Cash is typically considered the most liquid asset, as it’s almost universally accepted. In other words, it’s easy to exchange cash for practically anything you want. A car, by contrast, is generally a less liquid asset than cash, since it requires some effort to find a buyer.